12 June 2020

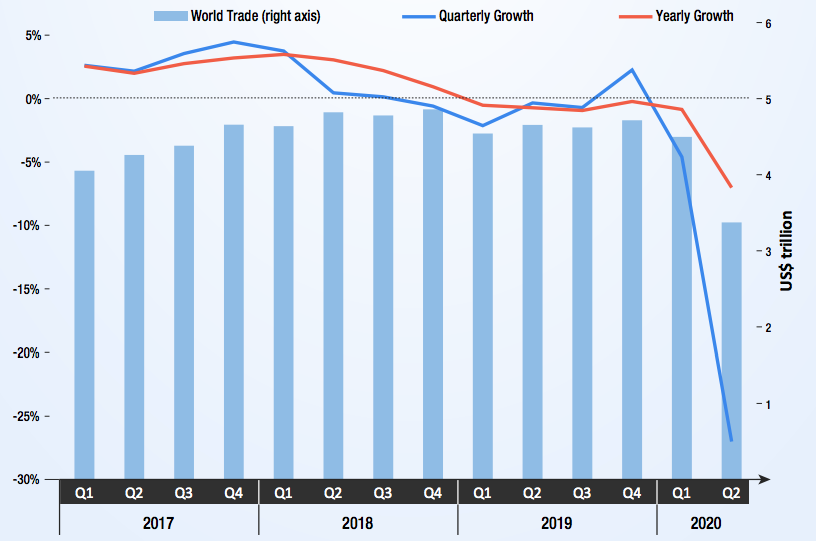

New UNCTAD data published on 11 June show that merchandise trade fell by 5% in the first quarter of the year and point to a 27% drop for the second quarter and a 20% annual decline for 2020. The latest UNCTAD figures were featured in the first edition of the Global Trade Update, the organisation’s new quarterly report providing a comprehensive snapshot of international commerce and the main issues affecting trade flows. Although the coronavirus-induced trade slowdown has spared no one, forecasts show a particularly rapid deterioration for developing countries. While south-south trade saw a drop of just 2% in the first quarter of the year, UNCTAD data shows a dramatic 14% fall in April. Preliminary data for April suggests the sharpest downturn for South Asia and the Middle East, which could register trade declines of up to 40%. Meanwhile, the East Asia and the Pacific regions appear to have fared best, with trade drops remaining in the single digits both in the first quarter of 2020 as well as in April. China appears to have fared better than other major economies in April, registering 3% growth for exports. But the most recent data indicates that the recovery may be short-lived, as the nation’s imports and exports fell by about 8% in May. The report further shows that economic disruptions wrought by COVID-19 have affected some sectors significantly more than others. In the first quarter of 2020, textiles and apparel declined by almost 12%, while office machinery and automotive sectors fell by about 8%. In contrast, the value of international trade in the agri-food sector, which has so far been the least volatile, grew by about 2%. Preliminary data for April indicates further declines in most sectors, with a very sharp contraction in the trade of energy (-40%) and automotive (-50%) products. Significant decreases are also observed in chemicals, machineries and precision instruments, with drops above 10%. On the other hand, office machinery appears to have rebounded in April, largely because of China’s positive export performance.